Managing your money well is very important. It helps you save, spend, and invest wisely. This guide will teach you all about personal finance management.

Credit: eddyandschein.com

What is Personal Finance Management?

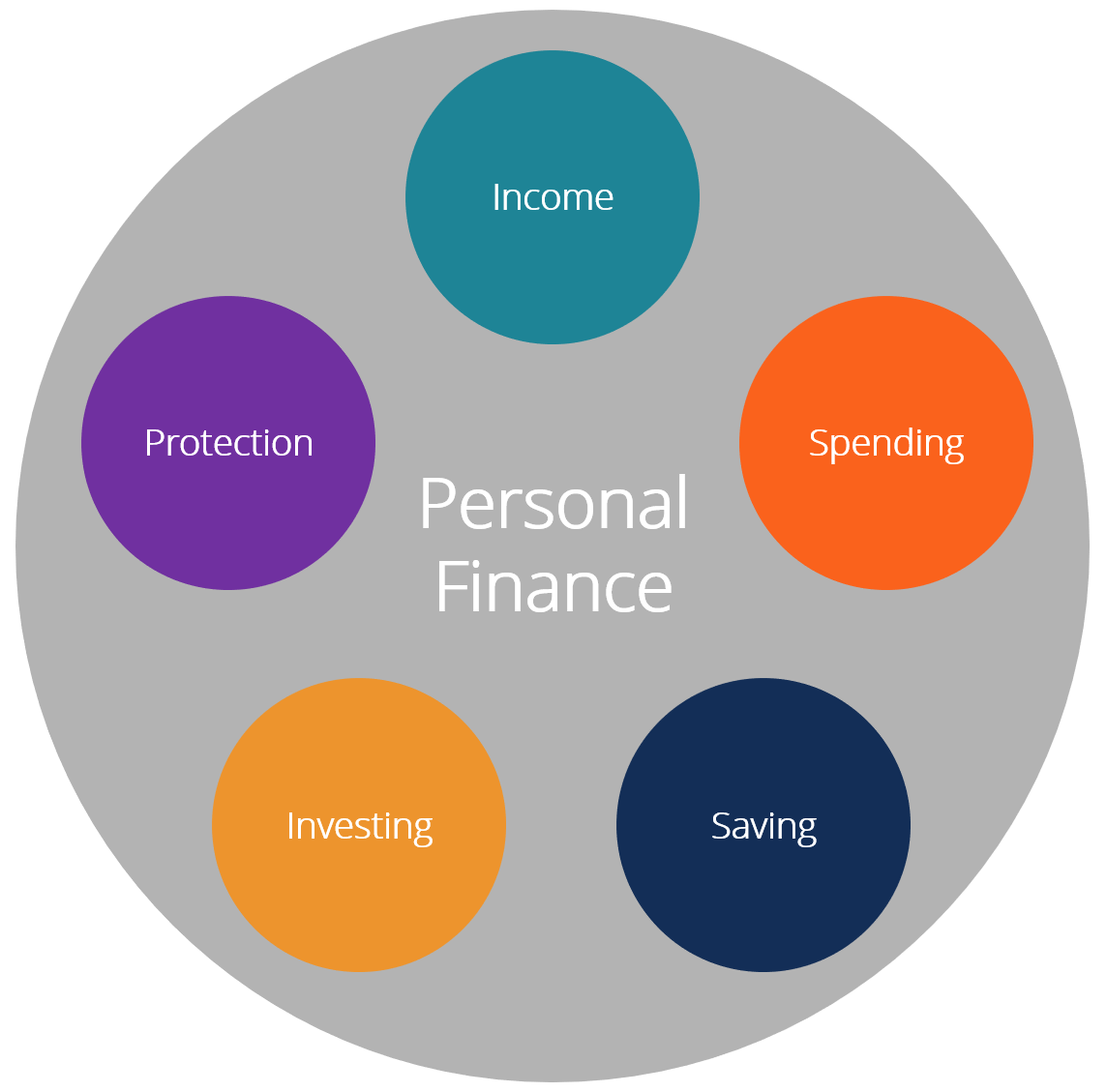

Personal finance management is the process of managing your money. It includes budgeting, saving, and investing. Good personal finance helps you reach your financial goals. It also prepares you for unexpected expenses.

Why is Personal Finance Management Important?

Personal finance management is important for many reasons:

- Control Over Spending: You decide where your money goes.

- Emergency Preparedness: You can handle unexpected expenses.

- Future Planning: You save for big goals like college or a house.

- Debt Management: You learn how to pay off debts wisely.

- Wealth Building: You invest for a better financial future.

Steps to Manage Your Personal Finances

Here are the steps to manage your personal finances:

1. Create A Budget

A budget is a plan for your money. It helps you track your income and expenses. Start by listing all your sources of income. Then, list your expenses:

| Income Sources | Expenses |

|---|---|

| Salary | Rent |

| Side Hustles | Utilities |

| Allowances | Groceries |

Subtract your expenses from your income. This shows how much money you have left.

2. Track Your Spending

Keep track of what you spend. You can use apps or a simple notebook. Write down every purchase. This will help you see where your money goes.

3. Save Regularly

Saving money is very important. Aim to save at least 20% of your income. You can open a savings account for this. Consider setting up automatic transfers to make saving easier.

4. Build An Emergency Fund

An emergency fund is money set aside for unexpected events. It helps you avoid debt. Aim to save 3 to 6 months’ worth of expenses.

5. Reduce Debt

Debt can be a big problem. Focus on paying off high-interest debts first. Consider the following tips:

- Make a list of all your debts.

- Pay more than the minimum amount due.

- Consider debt consolidation options.

6. Invest Wisely

Investing is a way to grow your money. Start small if you are new. Consider these options:

- Stocks: Buying shares of companies.

- Bonds: Lending money to companies or governments.

- Mutual Funds: Investing in a pool of stocks and bonds.

7. Review And Adjust Your Plan

Your financial situation may change. Review your budget every month. Adjust your spending and saving as needed.

Tips for Successful Personal Finance Management

Here are some tips to help you succeed:

- Set Clear Goals: Know what you want to achieve.

- Stay Informed: Read about personal finance.

- Be Disciplined: Stick to your budget and savings plan.

- Seek Help: Consider talking to a financial advisor.

Common Personal Finance Mistakes to Avoid

Here are some mistakes to avoid:

- Not having a budget.

- Ignoring savings.

- Using credit cards too much.

- Not investing early.

Resources for Personal Finance Management

Many resources can help you manage your finances better:

- Books: “Rich Dad Poor Dad” by Robert Kiyosaki.

- Websites: Visit sites like NASDAQ for investing tips.

- Apps: Use budgeting apps like Mint or YNAB.

Credit: corporatefinanceinstitute.com