Cryptocurrency trading is exciting. It offers many opportunities. But it can also be risky. A good trading strategy is essential. This guide will help you understand it.

What is Cryptocurrency?

Cryptocurrency is digital money. It uses technology called blockchain. Bitcoin is the first and most popular. Other examples include Ethereum and Litecoin.

Why Trade Cryptocurrency?

- Potential for high returns

- Market is open 24/7

- Access to global markets

- Diverse investment options

Basics of Cryptocurrency Trading

Before you trade, understand some basics.

Understanding Exchanges

Exchanges are platforms where you buy and sell. Popular exchanges include:

- Binance

- Coinbase

- Kraken

Types Of Trading

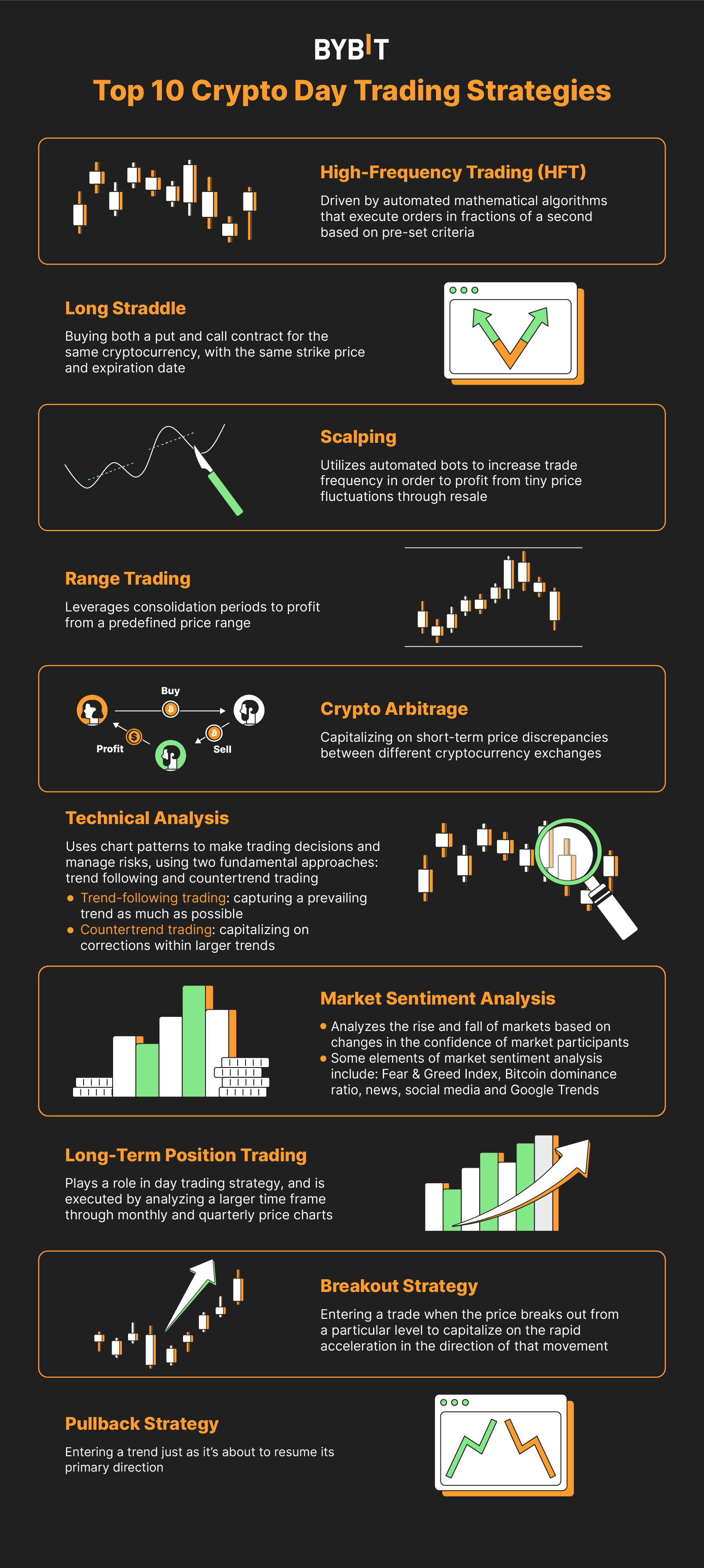

There are several types of trading:

- Day Trading: Buying and selling within the same day.

- Swing Trading: Holding for days or weeks.

- Scalping: Making small profits quickly.

Credit: arbismart.com

Developing Your Trading Strategy

Creating a trading strategy is important. Here are steps to follow:

1. Set Clear Goals

Know why you want to trade. Are you looking for quick profits? Or are you saving for the future?

2. Choose Your Trading Style

Select a style that fits your personality. Do you prefer fast trades or slower ones?

3. Learn Technical Analysis

Technical analysis uses charts and indicators. It helps you predict price movements. Some common indicators are:

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

4. Use Fundamental Analysis

Fundamental analysis looks at news and events. It helps you understand the market. Keep an eye on:

- Regulatory news

- Technological updates

- Market trends

5. Risk Management

Protecting your money is crucial. Here are some tips:

- Never invest more than you can afford to lose.

- Use stop-loss orders to limit losses.

- Diversify your portfolio to reduce risk.

6. Keep Emotions In Check

Trading can be emotional. Don’t let fear or greed drive your decisions. Stick to your plan.

Read more: Yiwu Jingyu E-Commerce Firm in Alibaba: Unleash Global Trade!

Popular Cryptocurrency Trading Strategies

Here are some popular strategies you can try:

1. Hodling

This strategy means holding your coins for a long time. It’s simple and can be effective.

2. Dollar-cost Averaging

Invest a fixed amount regularly. This reduces the impact of price changes.

3. Trend Following

Buy when prices are rising. Sell when they start to fall. This strategy requires good timing.

4. Arbitrage

This strategy takes advantage of price differences on exchanges. Buy low on one and sell high on another.

5. Swing Trading

Hold onto your assets for days or weeks. This strategy looks for price swings.

Tools for Cryptocurrency Trading

Using the right tools can help you trade better. Here are some essential tools:

1. Trading Platforms

Choose a reliable trading platform. Ensure it’s easy to use and secure.

2. Charting Tools

Use charting tools to analyze price movements. TradingView is a popular choice.

3. News Aggregators

Stay updated with the latest news. Websites like CoinDesk and CoinTelegraph are helpful.

Common Mistakes to Avoid

Even experienced traders make mistakes. Here are some common ones:

- Not having a plan

- Overtrading

- Ignoring fees and taxes

- Chasing losses

Credit: stormgain.com